Whether you are investing in patents as an investment vehicle or looking to build a portfolio, it is important to understand the importance of evaluating patent portfolios based on quantity and quality. This will help you to make the most effective decisions regarding your intellectual property portfolios.

Evaluating a patent portfolio can provide valuable insights into the strength and value of a company’s intellectual property assets. When evaluating a patent portfolio, it is important to consider both the quantity and quality of the patents. Here’s how to evaluate a patent portfolio based on quantity and quality:

- Quantity: The number of patents held by a company can be a good indicator of its level of innovation and its commitment to protecting its intellectual property. A large patent portfolio may indicate that a company is actively engaged in research and development and is well-positioned to defend its products and technologies.

- Quality: The quality of a patent portfolio is just as important as its quantity. High-quality patents are those that are well-written, have a broad scope, and are likely to be enforceable. Evaluating the quality of a patent portfolio can be challenging, but it is essential to ensure that the portfolio provides maximum protection and value.

- Relevance: It is also important to consider the relevance of a patent portfolio to a company’s business strategy and products. Patents that are aligned with a company’s products and technologies are more likely to provide strategic value and to generate revenue.

- Market analysis: Analyzing the competitive landscape and market trends can provide valuable insights into the potential value of a patent portfolio. Understanding the market potential and potential licensing opportunities can help to prioritize investments in the patent portfolio and to identify areas for improvement.

In conclusion, evaluating a patent portfolio based on quantity and quality is an essential part of managing a company’s intellectual property assets. By considering the relevance of the portfolio to the business strategy, conducting market analysis, and evaluating the quality of the patents, you can better understand the value and potential of your patent portfolio.

Quantity vs. quality

Managing a patent portfolio requires the proper balance between quantity and quality. Achieving this balance requires a thorough assessment of patent quality and business objectives. It also involves balancing investment resources to ensure that the portfolio supports strategic goals.

The balance between quantity and quality is not easy to achieve, but it is important to do so. It can help a company meet its IP goals and minimize its risk and expense. There are many useful tools available to assist with this process. In future articles, we will discuss the different parameters used in measuring quality. We will also review other measures that can provide useful information on patent quality.

A number of factors can affect the probability of developing high-quality patents. These factors include the quality of the invention, the value of the invention, the number of citations, the geographic scope of the patent, the number of patent families, and the length of the inventor’s career.

Counting the number of patents is an easy way to evaluate a patent portfolio. However, it does not necessarily indicate the quality of the patents. Some patents have more patents, but they do not have more value.

A more accurate approach to evaluating a patent portfolio is to use metrics to determine the quality of a patent. These metrics can be viewed in three main categories: quantitative, qualitative, and a latent variable.

A patent’s ability to exclude others is a strong indicator of quality. In addition, the number of citations it has received indicates its importance. In addition, the patent’s scope of coverage is a measure of its technological complexity. Using metrics to evaluate a patent can lead to improved decision making.

Patents can be used to mitigate risks or as collateral in financing. They can be monetized through direct sale or licensing. A large patent portfolio can also discourage a competitor from entering the technology space.

Ultimately, the key to developing a high-quality patent portfolio is to develop a strategy that aligns with the objectives of a company. This strategy will vary depending on the industry and market.

Principles of investing in patents

Managing patent portfolios is crucial to the success of any company. The goal is to balance quantity and quality to maximise the value of the investment. The strategy will vary depending on the size and goals of the business.

Quantity is usually measured in terms of patents, while quality is often associated with the number of times a patent has been cited. Both are important but vary significantly depending on the goals of the business.

Larger companies can hire patent attorney, while smaller companies may need to implement more cost-effective strategies. Obtaining a high-quality patent may require lengthy negotiations with the patent offices. Having a patent with a compelling story can increase the odds of success.

There are several techniques used to calculate the value of a patent. The present value method converts the anticipated economic benefits of the patent into a present value. The income approach uses a discount rate that takes into account risk. It is less common than the cost approach, which is based on the economic principle of anticipation and substitution.

Some analysts have offered alternative approaches. They use option pricing models to determine the value of a patent. These are based on the assumption that the investor will pay no more for an investment than they would for an equal utility investment.

Another option is to create a custom-built approach. This approach can include combining patent data analytics tools to improve the efficiency of portfolio management. It can also be used to identify patent applications with low value-based metrics. The resulting patents are then prioritized based on their stories.

Some companies use an approach called the relief-from-royalty method. This method estimates the costs associated with replicating the intellectual property. This can be done by calculating the value of a future royalty income stream. The benefit of this method is that it is simple to implement.

When building a patent portfolio, it is important to understand the implications of patent policy changes. These changes can have a chilling effect on innovators and investors. For example, large patent portfolios are often seen as a barrier to entry for competitors.

Problems with evaluating patent portfolios by the number of patents they contain

Managing a large patent portfolio can be a daunting task, especially when your competitors have a bigger budget and a better attorney. But it is not the end of the road if you make a strategic choice and take control of your own destiny. This is particularly true if you are a smaller company with a less than ideal track record. To this end, a patent management strategy should be a top priority. Luckily, you can do it all while maximizing the quality of your inventions.

The patent-management aficionado might consider an innovation analytics solution, like that offered by LexisNexis PatentSight, as the steward to your prized possession. The platform allows you to mine data in order to deliver actionable insights to you and your team members. Its numerous features are akin to having a team of expert data scientists on your side. Among other capabilities, the platform provides access to patent records from over 56 different patent authorities simultaneously. The main drawbacks of the platform are the cost and time commitment. However, they can be mitigated with a small yearly subscription fee. The benefits are well worth the expense.

The platform also provides access to a slew of patents that you cannot find in the usual site.

Patent data analytics tools present opportunities to optimize the overall value of patent portfolios

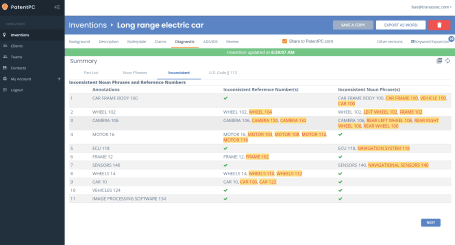

Using Patent data analytics tools provides a wide range of opportunities to optimize the overall value of a patent portfolio based on quantity and quality. These tools can be a powerful tool for improving patent portfolio management and helping to guide the patent prosecution process.

A strategic patent portfolio is vital to the financial success of any company. Its size should be tailored to the business needs of the company and the priority it has for acquiring, maintaining, and licensing patents. It should be built in conjunction with patent counsel and should incorporate the business strategy. It is important to choose patent counsel that understands your business and knows the key aspects of your products and services. The more knowledge your counsel has, the faster he or she can identify quality issues and recommend appropriate measures to improve the patent portfolio.

For example, a strong patent portfolio can help to create a barrier to entry for competitors in a technology space, discourage patent disputes, and increase profit margins. It can also be used to protect market share, and to mitigate risks. A high-quality patent can be used as collateral for financing or licensing, or for monetisation.

Investing in patents can be expensive, and there are many factors that affect the cost of a patent. These include filing fees, preparation costs, maintenance fees, and periodic maintenance taxes. However, saving on these expenses can be used to support new, higher-quality patents.

While patent data analytics tools will never replace judgment-based valuation analyses, they can improve the efficiency of portfolio management and provide more useful information to your patent counsel. For instance, they can be used to predict the examiner’s approach to a patent application, identify leading candidate patents, and identify trends in the same technology space as your active patent applications.

Combining the data provided by several patent data analytics tools can identify high-quality patent applications. These patents may be in high-value ranges, or they may need to be improved on. By identifying these low-value, high-metric patents, you can more effectively manage your patent portfolio. Combined with your own expertise, patent data analytics tools can help to focus your resources on the most valuable patents.