Introduction

No matter the size or stage of your company, it’s essential to comprehend how venture capitalists perform due diligence. Doing this allows them to make informed decisions when investing in your startup.

One of the most frequent due diligence activities is an assessment of a company’s patent portfolio. Unfortunately, this can be costly and not always relevant to investors.

Venture capital due diligence is a critical step in the investment process for venture capitalists. It is the process by which investors evaluate a potential investment opportunity to determine whether or not it is a suitable fit for their portfolio and aligns with their investment objectives. Due diligence involves thorough research and analysis of a company’s financials, management team, market opportunities, competition, and other key factors that may impact its future performance.

How to Get Started

What is venture capital due diligence?

Venture capital due diligence is a fundamental element of the investment process, guaranteeing all risks are identified and understood, so potential investors have an in-depth comprehension of your business and any obstacles to its expansion. The top venture capital firms dedicate extensive resources to this task; getting it right is paramount.

A venture capital firm will also assess any intellectual property owned by the company, such as copyrights or trade secrets. These types of assets are highly vulnerable to theft or damage, so a good VC will want to see that your firm has taken steps to safeguard its IP.

The venture capital due diligence process typically begins after an initial screening of the opportunity. If the opportunity is deemed promising, the investor will proceed with a deeper analysis of the company, including its financial statements, business model, and operations.

Key steps in venture capital due diligence

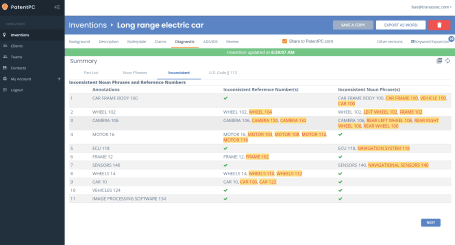

The initial step in developing an intellectual property strategy for a company is to review all existing patents, trademarks, and copyrights. This includes reviewing any applications or correspondence with the United States Patent and Trademark Office or United States Copyright Office as well as checking on any granted patents.

Venture capitalists (VC firms) also review a company’s contracts with customers and vendors, such as marketing partnerships, distribution deals, licensing arrangements, and other commercial agreements. These arrangements will have an effect on how competitively the business can compete within certain sales channels or market segments. Furthermore, VC firms look into whether these arrangements are profitable or potentially put the company’s IP at risk.

Investors may require the target company to obtain a freedom-to-operate (FTO) opinion from outside counsel, which is an intricate and costly process. This will identify any third-party patents which might be impeding development and sales in the marketplace.

This study is especially crucial when purchasing small companies that may be unaware of third-party IP owners, as it will enable investors to gauge how much freedom to operate the product after the deal.

Venture capitalists frequently request to see a corporate audit. This is an exhaustive examination of all documents showing ownership in the company, from incorporation documents and minutes of meetings to contracts with executives, key employees, and contractors. In sum, the venture capital due diligence process can be divided into five key steps financial, management, market, legal, and operations.

Financial Due Diligence

Financial due diligence is the first step in the venture capital due diligence process. The investor will analyze the company’s financial statements, including income statements, balance sheets, and cash flow statements, to determine its financial health and sustainability. The investor will also examine any existing debt or equity financing, including term sheets, loan agreements, and other financing documents, to understand the company’s capital structure and funding history.

Management Due Diligence

The management team is a crucial aspect of any startup, and venture capitalists pay close attention to the team’s experience and expertise. During management due diligence, investors evaluate the leadership team’s track record, their ability to execute the company’s vision and the depth of their industry expertise.

Market Due Diligence

Market due diligence is the third step in the venture capital due diligence process. Investors will evaluate the company’s market opportunity, the size of the market, and the potential for growth. They will analyze the company’s competitive landscape, including existing competitors and potential entrants, to understand the risks and opportunities in the market.

Legal Due Diligence

Legal due diligence is an essential component of venture capital due diligence. Investors will review the company’s legal documents, including articles of incorporation, shareholder agreements, and intellectual property filings, to ensure the company’s legal compliance and ownership of key assets.

Operational Due Diligence

Operational due diligence focuses on the company’s operations and processes. Investors will evaluate the company’s internal controls, supply chain, and technology infrastructure to assess the company’s ability to scale and adapt to changing market conditions.

Preparing for the Due Diligence Process

The due diligence process is an integral component of any business deal. It helps investors assess the risk associated with an investment and decide if they want to invest in a company. Venture capitalists use various methods for conducting due diligence on companies, including reviewing financial records, interviewing management personnel, and assessing potential hazards related to investing.

The intellectual property (IP) due diligence process is another essential step in the startup venture financing process. This involves an exhaustive examination of a startup’s patent portfolio. Doing this gives venture capital firms a comprehensive view of how tech startups will utilize their intellectual property going forward and helps ensure it remains protected.

A thorough IP due diligence process can be a game-changer for startups. It helps the business reduce the risks associated with its patents and boosts the likelihood that venture capitalists will invest in it.

What you need for the due diligence process

During the patent due diligence process, the team will consider several elements that impact a startup’s IP quality. These can range from the quality of their patent applications to whether they possess valid patent claims.

For a startup to be successful, it must own its intellectual property. This requires that the founders guarantee that their patents are registered in their name and protected from unauthorized use. Furthermore, signing patent ownership warranties and indemnities that guarantee ownership of the company’s IP is essential.

Before initiating the patent due diligence process, it is essential that a startup entrepreneur create a list of their Intellectual Property assets. This should include patents, trade secrets, copyrights, and trademarks.

Entrepreneurs should then submit these items to a venture capital firm for evaluation. Furthermore, they should be ready to explain how Intellectual Property relates to the startup’s products and services.

Entrepreneurs must involve legal counsel in the IP due diligence process, so they can review the information and assist with any decisions related to a patent portfolio. This is particularly pertinent for startup companies with patents as their IP may represent a substantial portion of their value.

During the Due Diligence Process

Venture capitalists typically steer clear of companies with weak IP protection, since they assume such companies will also have inadequate management.

Therefore, investors who invest in a startup company must typically perform due diligence on its intellectual property (IP). This is why patent due diligence plays such an important role during the investment process.

What the due diligence process entails

The patent due diligence team typically consists of both venture capitalists and tech company executives. During this stage, both parties will conduct a comprehensive review and analysis of the tech company’s patent portfolio.

It is essential that companies prepare for the due diligence process ahead of time. Doing so helps the team avoid issues that could impede progress on the deal and ensure everything runs smoothly during this crucial stage.

For instance, the team may need to review all employment contracts signed by the company’s founders and key employees. Furthermore, they will want to confirm that there are stock purchase agreements or unit purchase agreements in place that clearly specify each employee’s share percentage in the business.

Besides, the team should investigate whether the company has a formal IP assignment agreement that requires all employees and contractors to assign their patents to it. If not, that raises serious red flags for potential investors.

Additionally, the VC team will want to review any consulting and independent contract agreements the company has with its employees or consultants. These contracts provide them with a better insight into the technology utilized, the business model operated on, and the legal status of that technology.

Another key point to keep in mind during the venture capital IP due diligence process is that many startups are founded by former employees of larger corporations or universities. Since these individuals often possess substantial IP rights from their previous employer, it’s essential to review any contracts the company has with these parties and any inventors listed on key patent applications.

Post-Investment

Venture capitalists (VCs) want to know the full value of your intellectual property assets and how they will aid in growing and succeeding your startup. This may involve an extensive investigation of your company’s patent and trademark portfolio as it relates to your business model, along with market analysis and any existing contracts which could restrict growth for your startup.

The initial step in the venture capital patent due diligence process is to compile an asset list of your company’s intellectual property assets. This should include all registered and unregistered trademarks, copyrights, and patents that you own or intend to develop. Furthermore, contingent rights such as licenses or encumbrances like security interests should also be included on this list.

Once you have a list of your assets, VCs will conduct a comprehensive investigation to assess their value and legal status. They’ll search the title to each asset, check for foreign registration or contingent rights, and guarantee they’re free from any encumbrances such as security interest grants or potential infringement claims.

AVC will review any IP agreements and contracts you have in place to safeguard your intellectual property, such as a patent and trademark licensing agreement or non-disclosure agreement with employees. These arrangements can shield your technology from competitors claiming that it infringes upon theirs.

A venture capitalist (VC) will evaluate your company’s business model to determine its feasibility and profitability, as well as if you possess the necessary personnel to take it forward. They look for companies with substantial revenue potential as well as an attractive return on investment (ROI).

This stage of the venture capital patent due diligence process relies heavily on interviews with key personnel within the startup. These discussions give VCs valuable insight into how your company functions, which is essential for its success.

Finally, VCs will review your company’s management team to assess whether it is effective in its role. This becomes especially critical if the business is growing rapidly. Having an experienced management team from various industries is necessary for a successful startup.

Conclusion

Venture capital due diligence is a critical step in the investment process. It requires a thorough analysis of a company’s financials, management team, market opportunities, competition, and other key factors that may impact its future performance. The due diligence process is a time-consuming and resource-intensive process, but it is essential to mitigate investment risks and ensure that investors make informed investment decisions.

Investors must be disciplined and rigorous in their due diligence process, ensuring that they have a comprehensive understanding of the company’s financials, management team, market opportunity, competitive landscape, legal compliance, and operations. By conducting thorough due diligence, investors can minimize investment risks and increase their chances of success in the highly competitive and dynamic world of venture capital.